Analysis of China-Related Issues in Slovak Media (2017-2020)

This project builds on previous extensive research performed by MapInfluenCE, which analyzed texts published by the Slovak media about China in the period from 2010 to June 2017. The comprehensive study undergirded a discursive analysis of China’s media coverage in four Central European countries. The findings of this project contributed to the necessary shift in awareness of media vulnerabilities and integration of the media into European and national mechanisms for foreign investment screenings.

MapInfluenCE analysts subsequently expanded their research to the following period, from mid-2017 to 2020. As media attention focused on topics related to China significantly increased, the research focused closely on two key topics – Chinese investment and China’s potential involvement in building 5G networks.

As part of the analysis, 15 Slovak media outlets were assessed, based on their popularity among the Slovak audience in the considered period. The dataset emanating from the research contains 379 texts on 5G networks and 420 texts on Chinese investments.

The results of the analysis are provided in the following infographics. The full detailed study covering Poland, Czechia, Slovakia and Hungary and providing context, interpretation of results and recommendations, is available below.

Chinese Investment

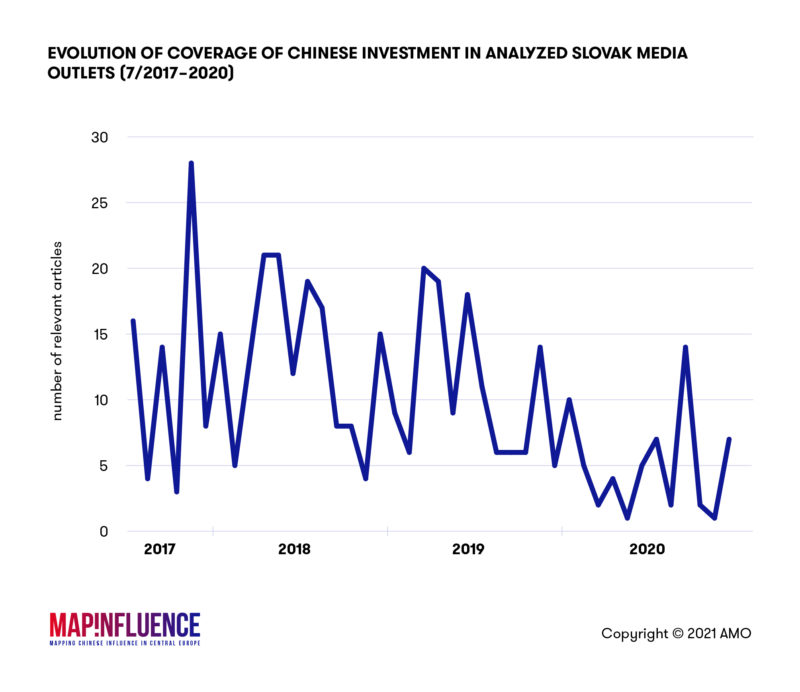

In the covered period, we see a decreasing trend in the coverage of Chinese investment. The coverage of Chinese investment in 2020 was approximately one third of the coverage the issue received in 2018. This trend coincides with a more sober view on the potential of attracting Chinese investment that we have seen in the past three years among Slovak politicians and experts.

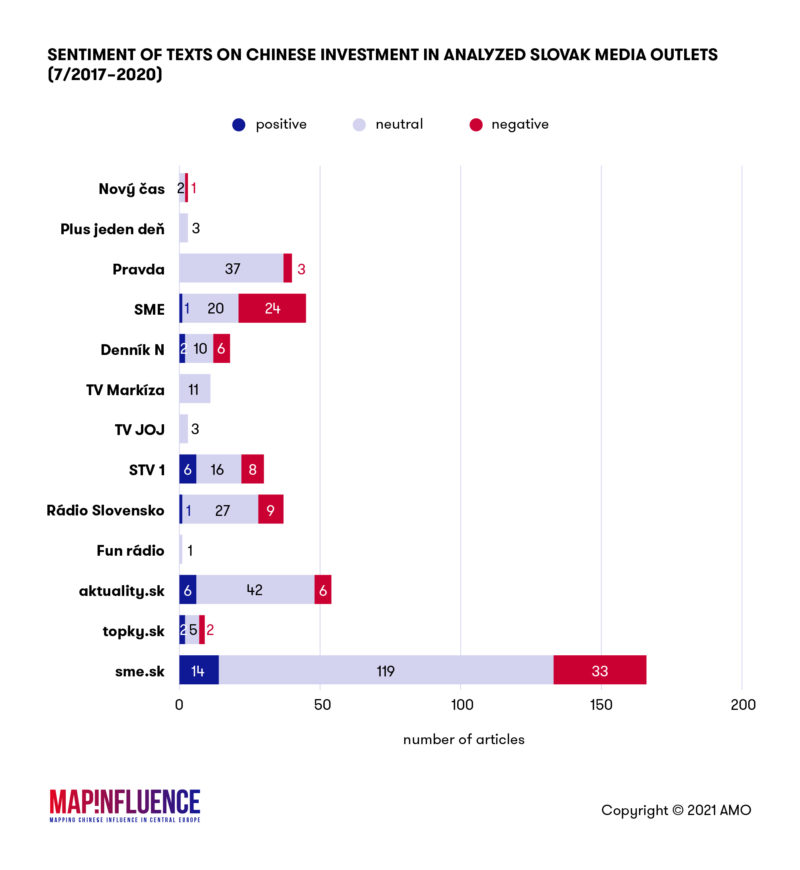

From the analyzed texts, which dealt with Chinese investment, 71 percent were coded as neutral, 22 percent articles were coded as negative, while only eight percent of articles covered the topic positively. While in 2017, only 14 percent of articles on Chinese investment were negative, in 2020 the share of negative articles has basically doubled (28 percent). At the same time, the positive coverage of Chinese investment increased until 2019, when the positive share was at its highest (10 percent) and then sharply dropped to a mere two percent a year later.

The sharp drop in positive coverage of Chinese investment can be attributed largely to a domestic political change in Slovakia in early 2020. Until March 2020, Slovakia was ruled by a governing coalition with SMER – Social Democracy, known to take on pro-Chinese positions in foreign affairs, repeatedly lauding the potential of Chinese investment in Slovakia. The new government of Slovakia, by contrast, has taken a more skeptical view. Taking power after the February 2020 general election, the right-of-center political parties forming the governing coalition are comparatively less enthusiastic about potential Chinese investment in Slovakia and have been known to raise concerns over potential security risks connected to them.

The most frequently covered topic by the media was Chinese investment in Slovakia, or lack thereof. Some 38 percent of articles focused on this topic. The second most frequent topic was Chinese investment in the EU, followed by infrastructure. The top 10 most frequent topics also included Chinese investment in the neighboring Czechia, technology, the auto industry, mergers and acquisitions, BRI, security, and Eastern Slovakia.

A little over one-quarter of articles were merely taken over by the media from various press agencies.

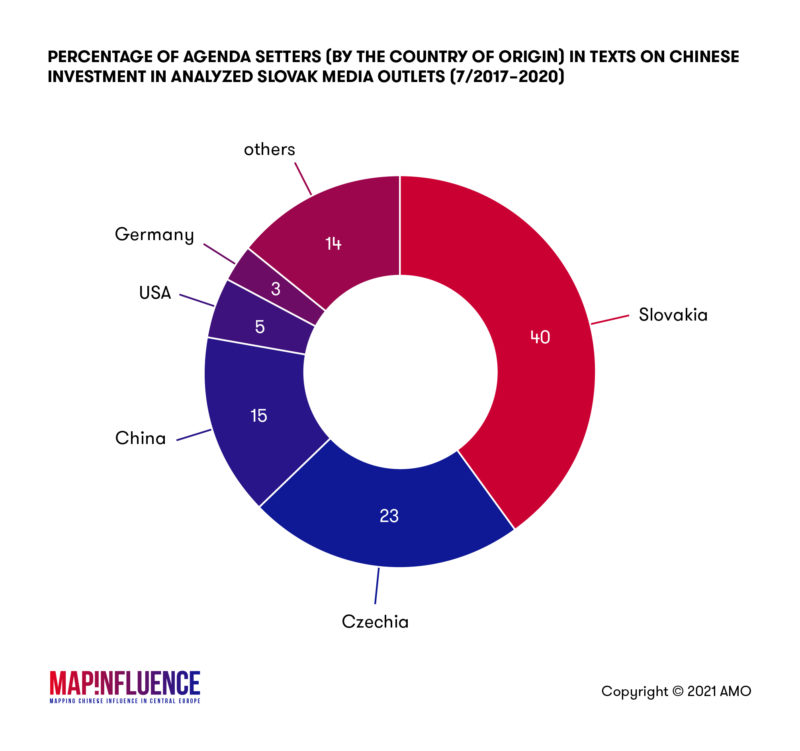

Altogether, we have identified 359 people who were in some capacity quoted in articles dealing with Chinese investment. Slovaks represented 40 percent of quoted persons. The remainder of those quoted by the media were of foreign origin, chiefly from the Czech Republic, China, the USA, and Germany.

5G Networks

China’s involvement in 5G buildup gained growing coverage in the same period. Similar to the Czech Republic, 5G became a real topic for the Slovak media in 2019. In 2018, Slovak media outlets included in our analysis published mere 17 articles on China and the 5G issue, while next year, the number has increased eleven-fold. Since then, the topic has been a staple in the coverage of China.

The increasing trend of covering China in connection to 5G has been driven by the global discussions on cybersecurity, especially among Slovakia’s NATO allies and co-members of the EU. The biggest coverage was recorded in May 2019, following the executive order by US President Donald Trump, which effectively banned all interaction between US companies and Huawei. Despite 5G receiving more traction in the last two years than the topic of Chinese investment, we could still observe a small decline in the number of articles discussing China and the 5G issue in 2020 compared to 2019. This is most likely due to the ongoing COVID-19 pandemic, where media attention paid to China likely shifted focus on pandemic-related topics.

China’s presence in 5G network construction is a relatively new topic in Slovak media discourse, as it started to appear only in 2018. While the number of articles published in 2018 has been low, it is still notable that there were no negative articles published that year. A significant majority of the 2018 coverage was neutral (88 percent), while 12 percent of articles were positive. Only two years later, in 2020, the situation was significantly different – some 12 percent of articles published were negative, while only 3 percent of articles on China and 5G had a positive narrative (remainder were neutral).

A vast majority of articles discussing Chinese involvement in the 5G networks naturally focused on the two main Chinese suppliers of the technology – Huawei and ZTE. This topic was raised in 85 percent of all articles. Among the remaining topics making the top 10 list, articles focused on Chinese espionage, national security, US-China conflict, cybersecurity, Chinese Communist Party and its regime, trade war, Huawei’s and ZTE’s competitors (Nokia, Ericsson, and Samsung), critical infrastructure, and human rights.

Almost one-half of all the pieces discussing China and 5G originated from press agencies. The Slovak media chiefly rely on TASR, the Slovak public press agency, followed by the local private agency SITA. Interestingly, the Czech press agency ČTK is also one of the sources, although to a lesser extent.

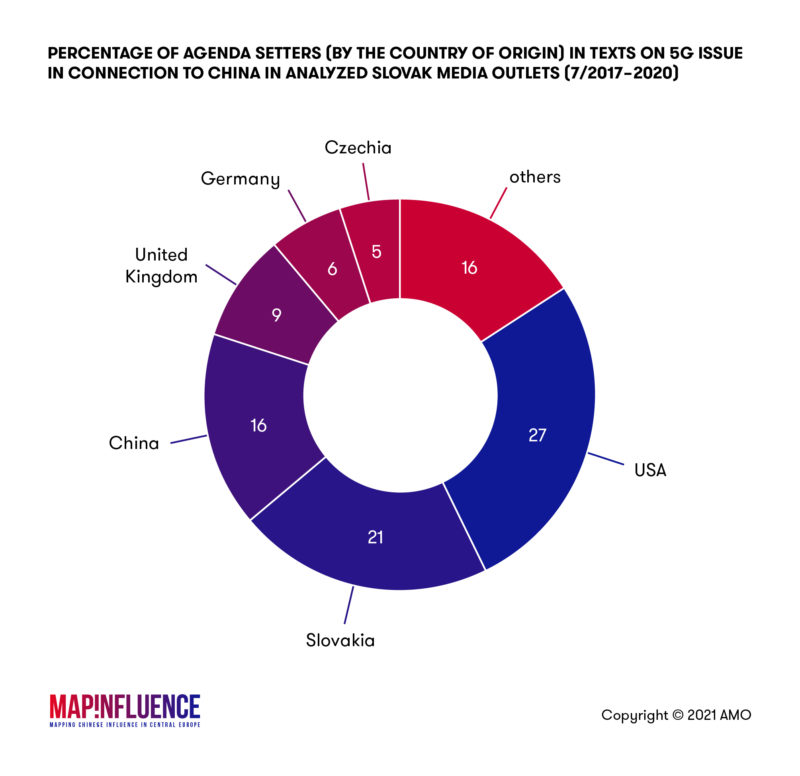

On the topic of China and 5G, 275 people were quoted in articles on China and 5G. Slovaks accounted for only 21 percent of citations. Slovak voices on China and 5G did not even achieve the highest share in the discourse, as US agenda setters provided 27 percent of quotes. Besides Slovaks and Americans, voices from China, the United Kingdom, Germany, and the Czech Republic featured prominently.

The low presence of Slovak voices in China-related topics, especially on 5G – a crucial topic from both security and economic viewpoints – points to a larger problem. Slovakia is facing a prolonged problem with brain drain, which naturally impacts also the field of China watching. As a result, Slovakia lacks enough domestic expertise to be able to develop both a domestic discourse on China as well as a substantial public discussion on challenges posed by China and Slovak response to them.

Interested in comparing the results with the situation in the other V4 countries? Check out the country analyses below.