Analysis of China-Related Issues in Polish Media (2018-2020)

This project builds on previous extensive research performed by MapInfluenCE, which analyzed texts published by the Polish media about China in the period from 2010 to June 2018. This comprehensive study undergirded a discursive analysis of China’s media coverage in four Central European countries. The findings of this project contributed to the necessary shift in awareness of media vulnerabilities and integration of the media into European and national mechanisms for foreign investment screenings.

MapInfluenCE’s analysts subsequently expanded their research to the following period, in case of Poland covering texts published from mid-2018 to 2020. As media attention focused on topics related to China significantly increased, the research only zoomed on into two key issues– Chinese investment and China’s potential involvement in building 5G networks.

As part of the analysis, 11 Polish media outlets were assessed, based on their popularity among the Polish audience in the considered period. The dataset emanating from the research contains 452 texts on China’s potential involvement in 5G build-up and 409 texts on Chinese investment.

The results of the analysis are provided in the following infographics. The full detailed study covering Poland, Czechia, Slovakia and Hungary and providing context, interpretation of results and recommendations, is available below.

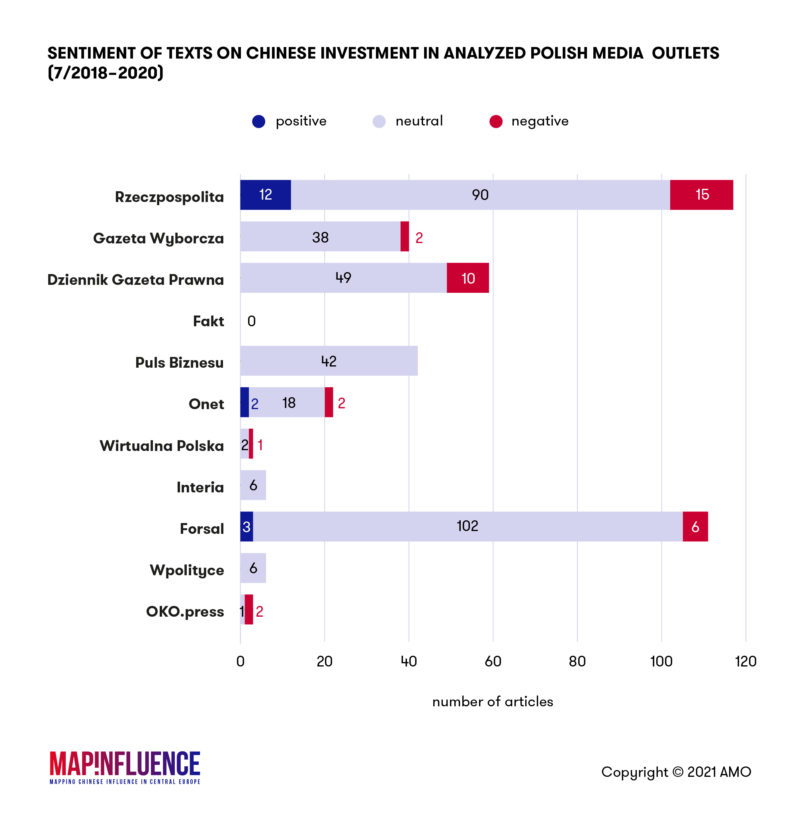

Chinese Investment

During the analyzed time frame, 409 texts on Chinese investment were found in the selected media (in total 90 were published in the second half of 2018, 167 in 2019, and 152 in 2020). Media interest in the subject was more or less stable throughout the studied period.

Neutral coverage prevailed, with 354 texts in total, representing over 86 percent of the whole dataset. Simultaneously, there were considerably more negative texts (38, more than nine percent of all) than positive ones (17 in total, four percent of the sample).

Interestingly, the focus of many of the analysed articles shifted towards strategic and security implications of Chinese investment instead of covering perceived benefits only, as it was the case in the previously studied period. Security-related issues were mentioned in over 36 percent of all analyzed texts. Moreover, in more than 40 percent of all pieces, Chinese investment was in one way or another depicted against the backdrop of the role of the US on the international arena.

As far as specific investment areas are concerned, infrastructure, innovations (artificial intelligence, Internet of Things, cloud computing) and energy sector appeared as the top-three most mentioned topics. Belt and Road Initiative (BRI) also attracted a lot of attention as it appeared in more than 26 percent of all texts, marking continuity with the previously studied period. Nevertheless, new topics also emerged, such as technology transfer and intellectual property rights violations or Chinese companies’ bad practices.

As the EU began to perceive China as not only an economic partner, but also a strategic rival, Polish media also evolved in its coverage. Noticeably, many outlets began to cover issues such as planned restrictions on Chinese investment in Europe or calls for trade and investment reciprocity on the Chinese market, albeit to a limited extent and mostly in the form of short news.

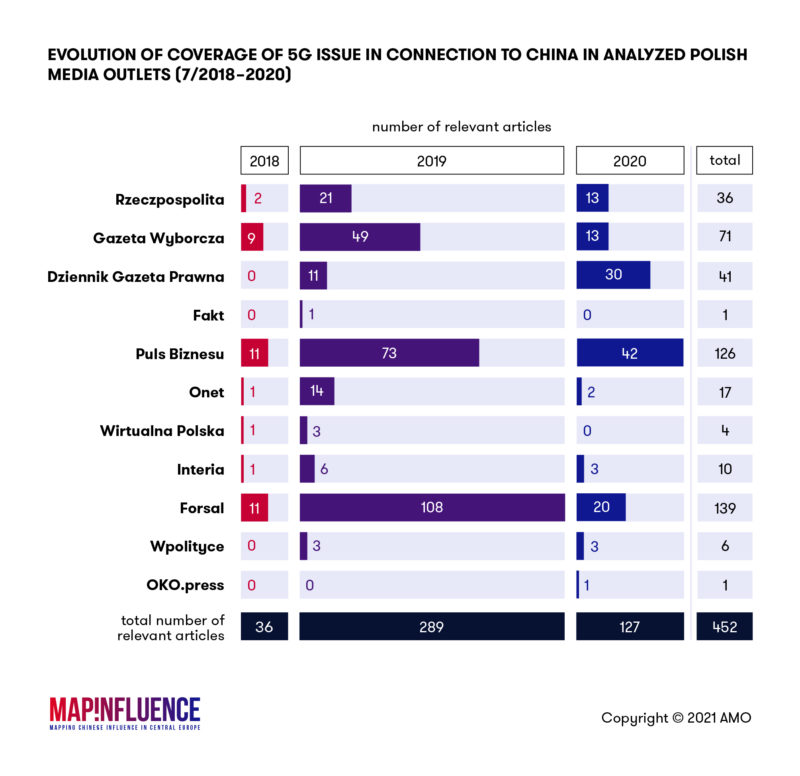

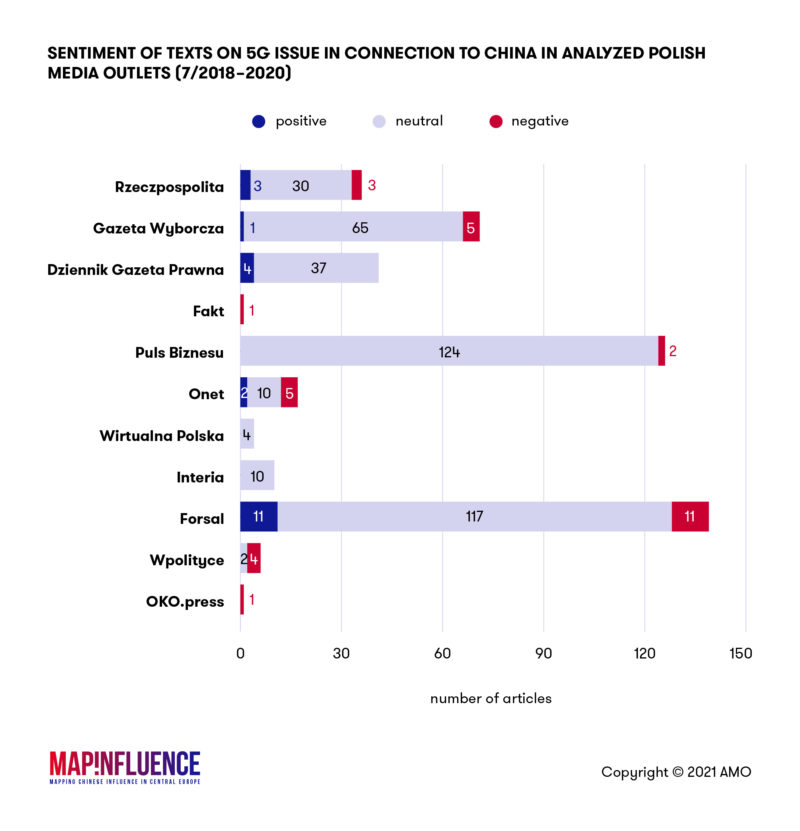

5G Networks

During the studied period, 452 texts on China and 5G were found in the chosen media (in total 36 were published in the second half of 2018, 289 in 2019 and 127 in 2020). In the overwhelming majority (9 out of 11) of researched media outlets, the number of published texts on the issue peaked in 2019.

When it comes to their tone, most articles were neutral (399 pieces representing over 88 percent of the whole sample). While decidedly positive and negative coverage was rare, the latter was more prevalent (21 positive texts vs. 32 negative).

Positive coverage was, to a large degree, the result of Huawei’s PR efforts as it came from interviews with Huawei representatives or Chinese diplomats (like the firm’s founder Ren Zhengfei, Ryszard Hordyński from Huawei Poland or China’s ambassador to Poland Liu Guangyuan) and some rare examples of sponsored content. Negative sentiment sometimes prevailed in opinion pieces that referred to some hawkish public figures or were direct interviews with these sources. A key example of such a ‘hawk’ is retired US Air Force Brigadier General Robert Spalding, a former Trump administration advisor known for his Sino-skeptic views.

Huawei and, to a much lesser extent ZTE, were the two companies that appeared in almost all articles that touched upon the topic of 5G and China in the Polish media.

The former was mentioned in 96 percent of analyzed media production, while the latter in over 16 percent. Initially, the two Chinese companies came up mostly in relation to mounting diplomatic tensions between Beijing and Washington as the Trump administration accelerated its efforts aimed at containing China’s rise. These efforts manifest also in the technological realm, such as in the imposition of restrictions on the operations of each firm in the US. In December 2018, Meng Wanzhou, Huawei’s CFO and the daughter of the firm’s founder, was arrested in Canada and charged with fraud for allegedly circumventing US sanctions against Iran.

The event made the headlines in Poland. Yet a month later, a bigger scandal broke out: a Chinese Huawei employee and a Polish national were arrested in Warsaw on allegations of spying for China. Looking back in time, the event served as a catalyst for the development of the domestic debate on 5G and China’s involvement in the process. The so-called “spying scandal” appeared in over 12 percent of all pieces covering China and 5G in the studied dataset sample.

Over time, security risks and cyber threats, as well as the role of the US, became the most prevalent topics within this debate. As the rivalry between Beijing and Washington escalated and its effects spilled over to third countries, Polish media began to cover domestic legal and political moves and adjustments in terms of Warsaw’s balancing of relations with both China and the US.

In total, over 19 percent of all studied texts referred to the Polish government’s plans to control and protect domestic 5G networks, also in the context of perceived threat coming from the firms with alleged ties to the Chinese government. Topics such as the role of domestic telecommunications providers (like Orange, Play, T-Mobile or Plus) and their cooperation with Huawei, potential costs of Huawei’s exclusion and the general economic impact of 5G also started to be touched upon in the media.

Evolving stories concerning Huawei’s treatment in different countries (especially Germany, the UK, and among the US allies) were monitored, with major developments covered quite extensively. When breakthrough documents were endorsed by the EU (EU 5G Toolbox) or Poland (US-Poland agreement on 5G cooperation), the media also reported on that. However, a lot of the coverage was purely informative, with few attempts to engage more critically with the topic and the events or processes surrounding it. A significant amount of coverage assumed a rather simplistic perspective, in which the US was pressuring Poland to make decisions in line with Washington’s interests. As such, little credence was offered to Warsaw’s own agency in decision-making processes.

Interestingly, Russia was also referred to more often than it might have been expected in the context of 5G and China: it appeared in over 10 percent of all studied texts. Oftentimes, it was mentioned in relation to its potential cooperation with Beijing in terms of creating international initiatives competing with the Western-led institutions, norms and standards.

Interested in comparing the results with the situation in the other V4 countries? Check out the country analyses below.