An expert debate titled Who is afraid of investment screening? International impact of the new Czech regulation organized by Association for International Affairs (AMO) was held on December 10, 2019, in Prague. The event was the first public debate of its kind regarding the draft law on foreign investment screening mechanism that will have major ramifications for the investment environment in the Czech Republic as well as the toolbox available to assess foreign security threats to the country. Despite its impact, the draft law has not yet been a subject of wider public discussion.

Ota Šimák, one of the authors of the proposed law from the Ministry of Industry and Trade (MPO), Matej Šimalčík, director of Slovak CEIAS institute, and Alice Rezková, international economy expert and AMO Research Fellow attended the panel. The debate was moderated by Ivana Karásková, China and investment screening expert and coordinator of ChinfluenCE project at AMO. Representatives of Embassies, chambers of commerce and other relevant institutions attended the event.

Alice Rezková put the proposed investment screening mechanism in the context of the efforts at the European level. In April 2019, an EU cooperation framework on foreign investment screening was passed to ensure Union-wide coordination and cooperation on the screening of foreign direct investments likely to affect security or public order. On the EU level, the European Commission and other member states can ask for information or provide comments regarding an investment to other EU country. The European Commission also encouraged the member states to enact their own relevant legislation. However, the decision whether to set up own national screening and to allow or block any particular investment will remain the sole responsibility of the member states.

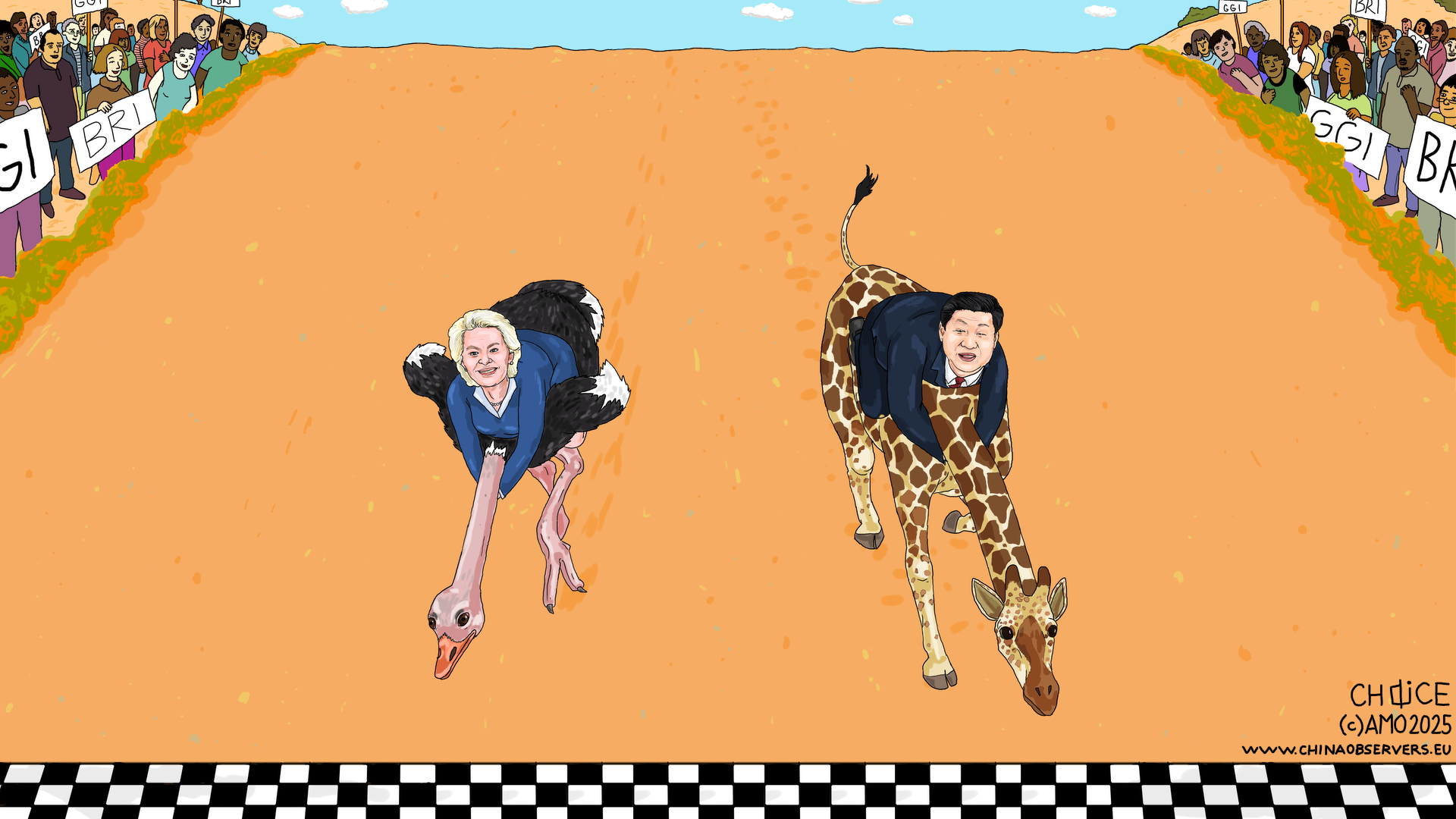

While it has never been explicitly linked to China, the EU and member states moves have been largely connected to Chinese investment activities. According to Rezková, there have been clear patterns of Chinese companies trying to acquire European know-how and technologies through acquisitions. This effort has been connected to China’s attempts to achieve self-reliance and leadership in top industry sectors as promulgated in the ‘Made in China 2025’ strategy.

The EU framework lists the factors to be taken into account in determining the potential to cause security threat as presence of links of investors to foreign governments or armed forces, previous involvement in activities affecting security or public order and presence of serious risk that investor engages in illegal or criminal activities.

According to Ota Šimák from MPO, the Czech government’s first moves to react to the potential negative security ramifications were concurrent with the initiatives on the EU level. The government realized that there were some foreign actors on the market who were not merely pursuing economic profit, but had also other, political goals in mind. The Czech regulation as it stood at the time did not offer the necessary instruments to meet this challenge and therefore, work on drafting an FDI screening mechanism was initiated. However, Ota Šimák stressed that the Czech Republic remains very much open to foreign investors and the draft law does not seek to limit their activities per se. Moreover, it is not discriminatory against any specific actor. However, the security risks have to be attended to.

The draft law introduces two general regimes for screening of investments: first category includes a limited number of critical sectors, where investments have to be permitted including critical infrastructure, defense, IT systems and dual-use technologies. All the other investments are not required to gain permission from the government. However, they can still be subject to a screening procedure if the government decides to do so in view of the potential security risks. This can be done before the completion of the investment but also within a 5-year time frame after its completion. To assuage the potential concerns of investors, a consultation mechanism has been embedded in the law. Any investor can seek consultation with the Ministry of Industry and Trade (responsible for the investment screening process) on the potential impact of the planned investment. The Ministry is required to issue a statement within 30 days.

MPO manages the screening, conducts the consultations and issues decision on the permission/prohibition of the investment or on ordering a divestment. In the screening process, the Ministry cooperates with other ministries and relevant institutions in the Czech Republic (listed in the draft law) which can provide statements on the investment. The government, however, is the final entity which approves or blocks the investment, even in case of a negative statement by the relevant institutions in the Czech Republic (including the security agencies). MPO will be also responsible for the inter-EU cooperation with other member states and the European Commission.

Matej Šimalčík commended the draft law as an important first step in the efforts to offset potential security risks associated with investments of problematic actors. In this respect, the Czech Republic is ahead of Slovakia, where the debate on the issue has not even started. However, Šimalčík brought up some potential issues with the draft law. Most importantly he commented on the lack of public oversight. As the draft law now stands, there is no mechanism for the public or for non-governmental organizations to challenge a decision of the government to allow a potentially risky investment. Governments may be prone to ignore the risks in case the investment serves their political goals. Therefore, public participation should be included in the law, drawing potential inspiration from existing environment or public procurement laws.

Another problematic aspect is the exemption of most of the relevant information to the screening process of individual investments from the freedom of information act. Šimalčík believes that this not necessary as freedom of information act provides for sufficient checks for the confidentiality of the sensitive information. According to Šimalčík, the draft law does not sufficiently take into account the potential risks related to acquisition of media by foreign actors. Risks of investments into Czech media have been uncovered by previous research done by the ChinfluenCE project coordinated by AMO, revealing that Czech media Týden and TV Barrandov changed their tone of reporting on China towards purely positive and also the topics which were covered in connection to China after their acquisition by a Chinese company CEFC in 2015. Finally, Šimalčík argued that MPO is in an inherent conflict of interest as it is both the agency interested in attracting investments to the country and also responsible for initiating an investment screening process against a potentially risky investment. Ideally, a fully independent institution would take up its place, or, at least, the agenda should be given to a different ministry.

Ota Šimák responded to Šimalčík’s concerns. According to Šimák, there is a need to protect sensitive information that companies provide during the screening, as releasing it could compromise the whole process. Regarding the media issue, Šimák stressed that while not covered under the obligatory screening regime, acquisition of media will still be screened if a potential risk of influencing public opinion through media is identified. Media are indeed a particularly sensitive sector in view of their potential misuse by foreign actors engaged in hybrid war seeking to influence the public opinion. Finally, Šimák believes that there is no inherent risk of MPO misusing its role in initiating the investment screening process. The relevant department at the Ministry is legally required to act on the solicited risk assessment from other government agencies that are involved in the process.

Finally, all the panelists agreed that the forthcoming law is a very important step that will bolster the toolbox available to the government to screen potentially risky investments with impacts on the security and public order of the country. At the same time, the mechanism will not have any negative effects on the overall investment environment in the Czech Republic that remains open and welcomes foreign investment from all around the world. However, the final version of the law and an actual implementation of the mechanism will, to a significant extent, depend on the political will of country’s politicians.

You can check the most recent version of the draft law here.

Image source: AMO