Similarly to other Visegrád Four states, Slovakia – an automotive monoculture within the ‘integrated periphery’ of the European auto industry, often called the ‘Detroit of Europe’ – finds itself at a critical juncture in its economic development as it shifts from manufacturing internal combustion engines to electric vehicles (EVs). Chinese EV and battery projects, alongside South Korean brownfield investments, are driving this transformation while bringing both opportunities and challenges for the country’s green and digital transitions.

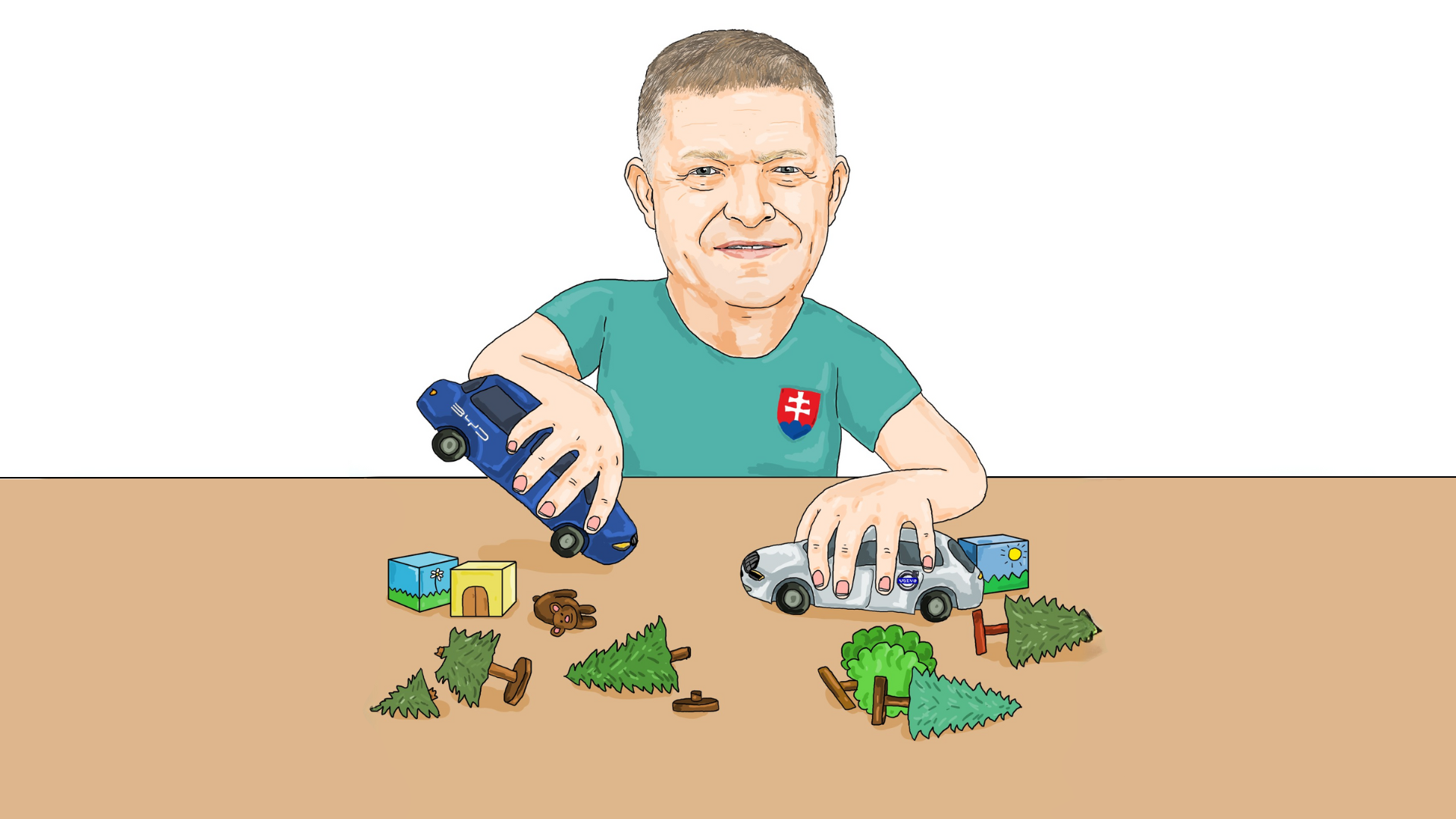

In this policy paper, Dominika Remžová, AMO’s China Analyst, examines two major Chinese investment projects in Slovakia: Volvo’s EV plant in Valaliky and the Gotion InoBat Batteries venture in Šurany, with a particular focus on their environmental credentials. While both projects promise jobs and industrial upgrading, they also expose deep tensions between economic opportunity, environmental sustainability, and European security. The Šurany project, in particular, has sparked strong local opposition over health, water, agricultural, and broader social and regulatory risks.

By situating these investments within the EU’s Environmental, Social and Governance (ESG) framework, the study reveals a complex picture in which short-term economic gains may come at the expense of long-term strategic considerations. It highlights the gap between Chinese and European ESG standards and calls for a more balanced approach to Chinese investment – one that leverages economic benefits while safeguarding Slovak and European priorities, including sustainability and security.