Analysis of China-Related Issues in Czech Media (2017-2020)

This project builds on previous extensive research performed by MapInfluenCE, which analyzed texts published by the Czech media about China in the period from 2010 to June 2017. The comprehensive study undergirded a discursive analysis of China’s media coverage in four Central European countries. The findings of this project contributed to the necessary shift in awareness of media vulnerabilities and integration of the media into European and national mechanisms for foreign investment screenings.

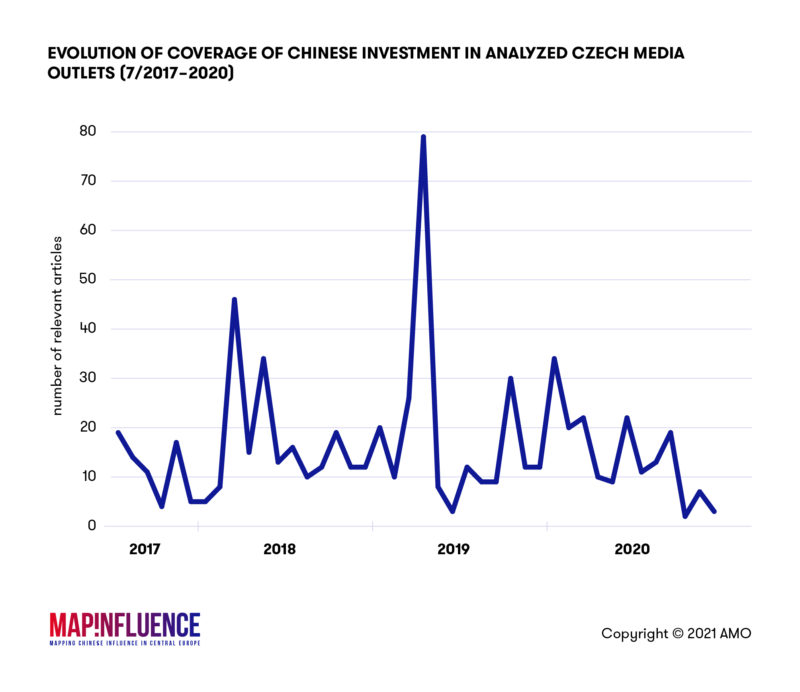

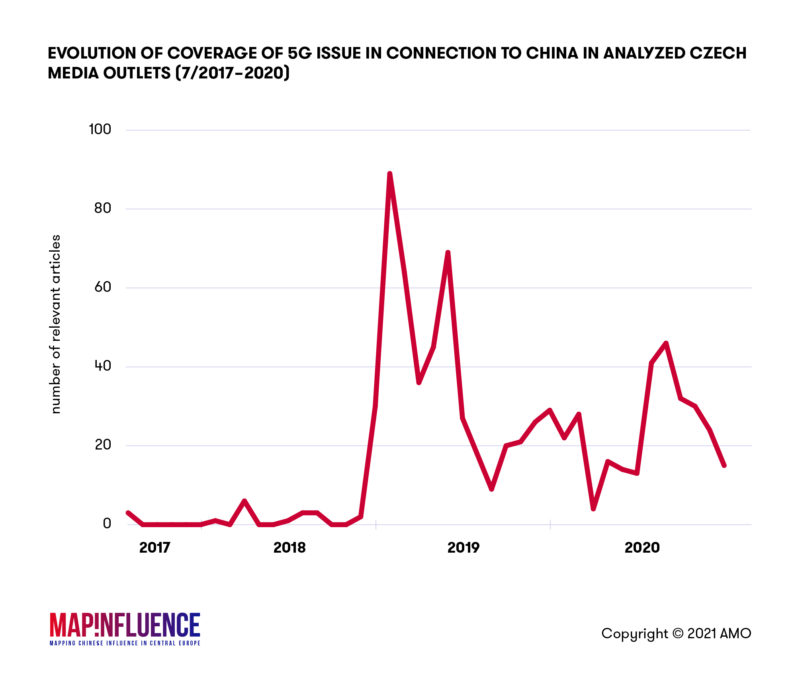

MapInfluence’s analysts subsequently expanded their research to the following period, from mid-2017 to 2020. As media attention focused on topics related to China significantly increased, the research focused closely on two key topics – Chinese investment and China’s potential involvement in building 5G networks.

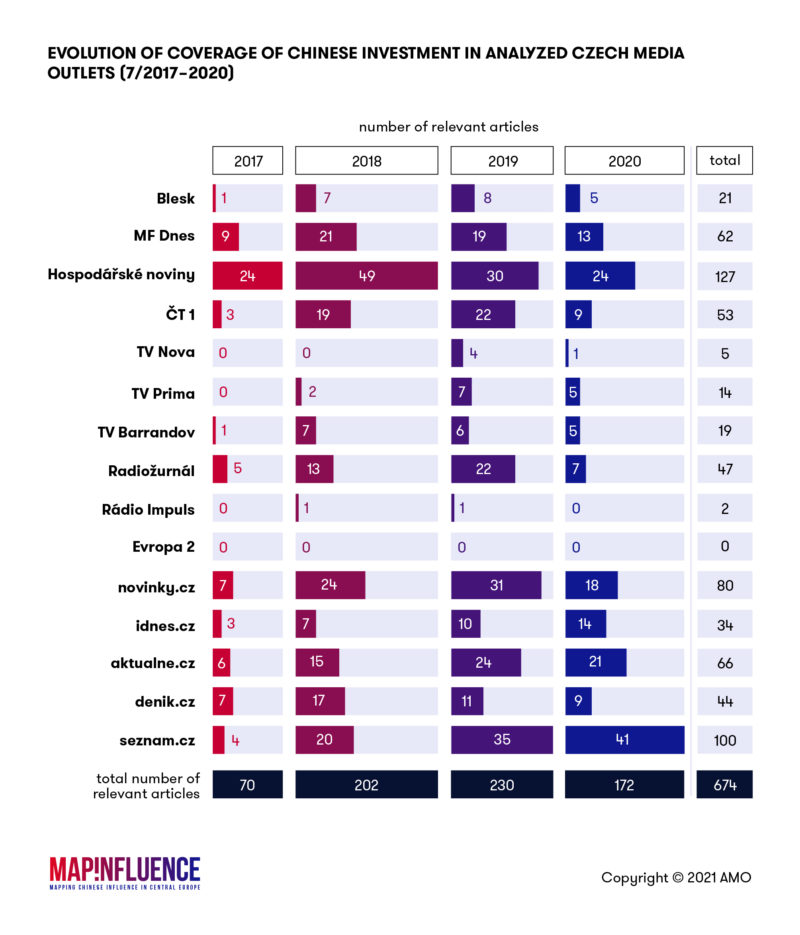

As part of the analysis, 15 Czech media outlets were assessed, based on their popularity in the Czech audience in the considered period. Due to the fact that previous research mapped the sudden occurrence of positive sentiment on China-related topics after CEFC’s financial involvement in Empresa Media, TV Barrandov was also included in the media file, despite it not meeting the set criterion of maximum viewership. The dataset emanating from the research contains 787 texts on 5G networks and 674 texts on Chinese investments.

The results of the analysis are provided in the following infographics. The full detailed study providing context, interpretation of results and recommendations is available here.

Chinese Investments

The data on media coverage of Chinese investment indicates it has been mostly domestic affairs that influence the local media production.

Three major events contributed to the increased media coverage: the investigation of CEFC in China and its debts in the Czech Republic, President Miloš Zeman’s fifth trip to China and his refusal to attend the 17+1 summit. With the outbreak of the COVID-19 pandemic, the issue of Chinese investment lost appeal and substance as the media diverted their attention towards other China-related issues.

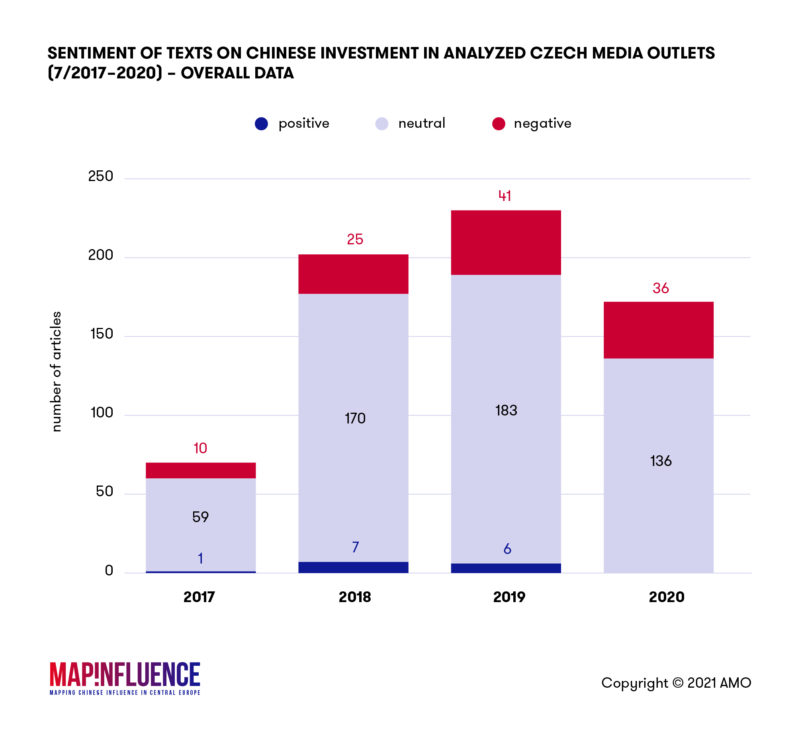

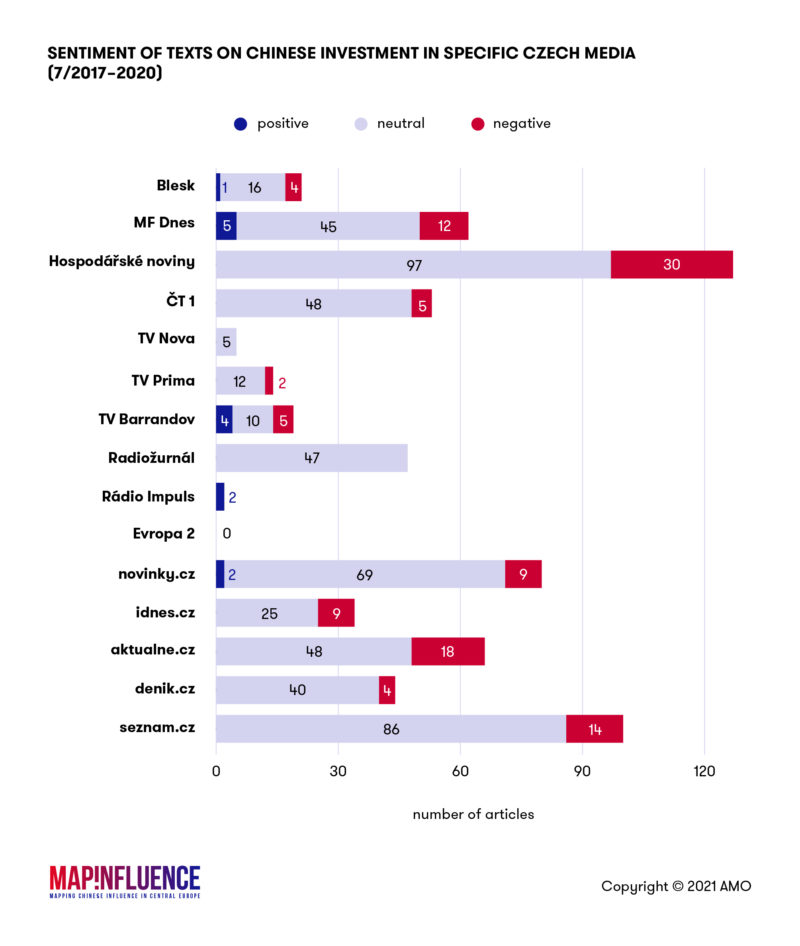

An overwhelming majority of texts (81 percent) was neutral, simply describing the amounts of investment, bilateral trade volume or positions and actions of the engaged politicians and lobbyists. 17 percent of the texts, however, were fairly critical, mostly appearing in the commentary sections or in the blogs and mentioning China’s activities abroad. Only two percent of texts were coded as carrying a positive sentiment.

The most varied approach can be observed in the case of TV Barrandov, which underwent a change from reporting on Chinese investment in an overwhelmingly positive manner, especially through regular interviews granted by the Czech President Miloš Zeman, until September 2018. Since November 2018, the president has been either vocally negative or neutral on the issue of Chinese investment in TV Barrandov. While Jaromír Soukup, the interviewer and also the co-owner of the TV station, was often negative on China in his questions towards the president, possibly to stir the discussion or to enable the president to challenge the position and present a positive view of China.

In general, it can be argued that the Czech media included in the analysis did not attempt to bring new information or conduct adequately thorough investigations of Chinese investment issues.

The lion’s share of attention has been paid to the actions of local political actors or lobbyists and the impacts of their activities. Most prominently, this features in coverage of President Zeman’s trips to China, Prague Mayor Zdeněk Hřib’s announcements in connection to sister-city agreement, or Czech Senate President Miloš Vystrčil’s trip to Taiwan. The issues revolving around Hřib and Vystrčil were both presented as having a potential impact on Chinese investment to the country and led to brief comparisons of the volume of Taiwanese and Chinese investment inflows to Czechia.

Attempts to cover more qualitative issues like CEFC’s global operations, the persona of Ye Jianming, or detailed analysis of Chinese investment (beyond a mere list of companies invested into by CEFC/CITIC) were conversely lacking.

To be sure, some outlets did make mention of security risks connected to Chinese investment, such as a dependency on China. Especially after 2019, the Czech media debate on Chinese investment was relatively flat.

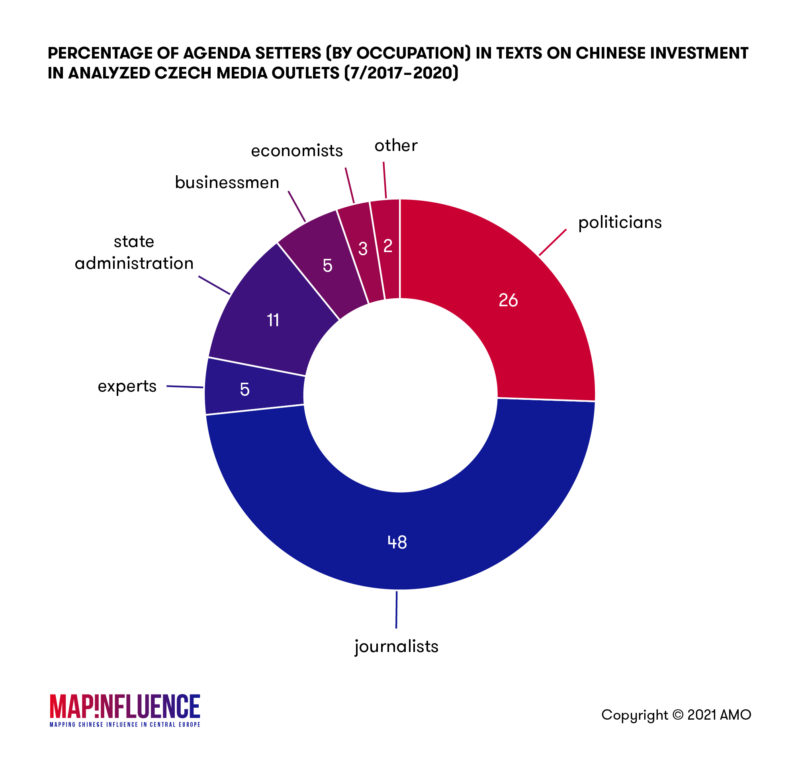

Unsurprisingly, the list of agenda setters is quite robust, comprising 439 authors, co-authors, or quoted persons. As authors and co-authors of the texts, journalists logically create the biggest category of agenda setters (48 percent), followed by politicians (26 percent), state administration staff (11 percent), representatives of business and business analysts (8 percent) and China experts (5 percent).

5G Networks

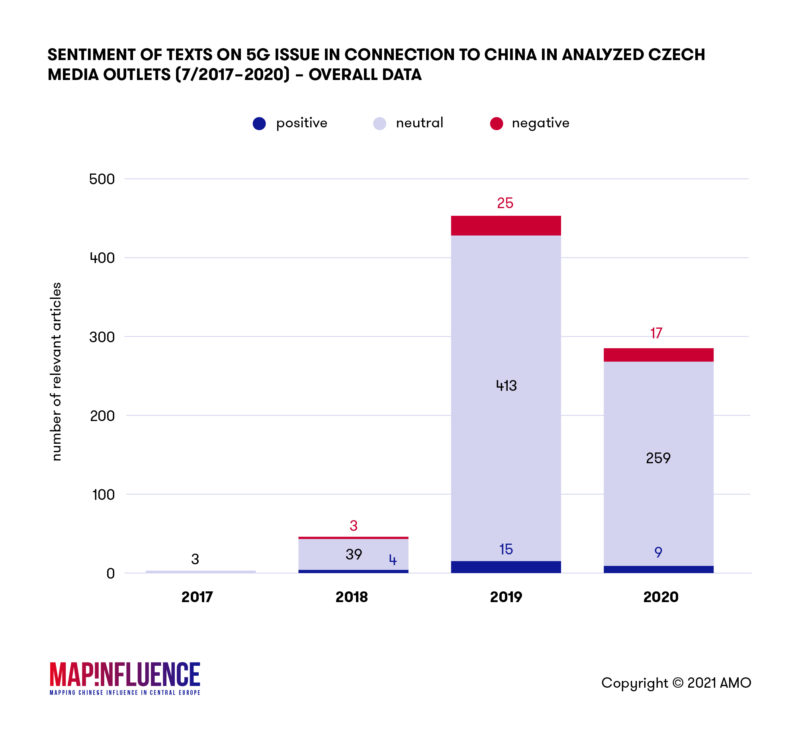

When compared to the previous issue of Chinese investment, the 5G-related debate was even more technical, resulting in mostly neutral sentiment (91 percent). The texts were mere descriptions of events and positions of politicians, recycling (without added value) the original warning of NÚKIB. Only 3 percent of the texts were positive and 6 percent were identified as clearly negative. Out of 28 positive reports, four in particular deserve a closer look as they were a direct result of commercial articles (‘advertorials’). The texts were placed on the denik.cz website in October 2020 and sponsored by Huawei.

An overwhelming majority of texts (81 percent) was neutral, simply describing the amounts of investment, bilateral trade volume or positions and actions of the engaged politicians and lobbyists. 17 percent of the texts, however, were fairly critical, mostly appearing in the commentary sections or in the blogs and mentioning China’s activities abroad. Only two percent of texts were coded as carrying a positive sentiment.

The most varied approach can be observed in the case of TV Barrandov, which underwent a change from reporting on Chinese investment in an overwhelmingly positive manner, especially through regular interviews granted by the Czech President Miloš Zeman, until September 2018. Since November 2018, the president has been either vocally negative or neutral on the issue of Chinese investment in TV Barrandov. While Jaromír Soukup, the interviewer and also the co-owner of the TV station, was often negative on China in his questions towards the president, possibly to stir the discussion or to enable the president to challenge the position and present a positive view of China.

The issue of security of 5G networks in the Czech Republic is mostly associated with Huawei, a Chinese telecom company with the highest share of components in local networks. Huawei is also arguably the most active Chinese telecom company in the V4 countries. ZTE and other Chinese companies have, at least so far, had a less visible presence.

The majority of analyzed texts focused on security risks, such as the existence of ‘back doors’ in Chinese companies’ software and China’s National Intelligence Law passed in 2017. This legislation creates affirmative legal responsibilities for Chinese but also some foreign citizens, companies, or organizations operating in China to provide access, cooperation, or support for Beijing’s intelligence-gathering activities, cases of espionage, etc. Other topics were associated with Chinese companies’ products, Sino-American relations, cooperation within EU or NATO on solving 5G problems, the position of Five Eyes countries on cooperation with China and links between Huawei and the Chinese Communist Party (CCP).

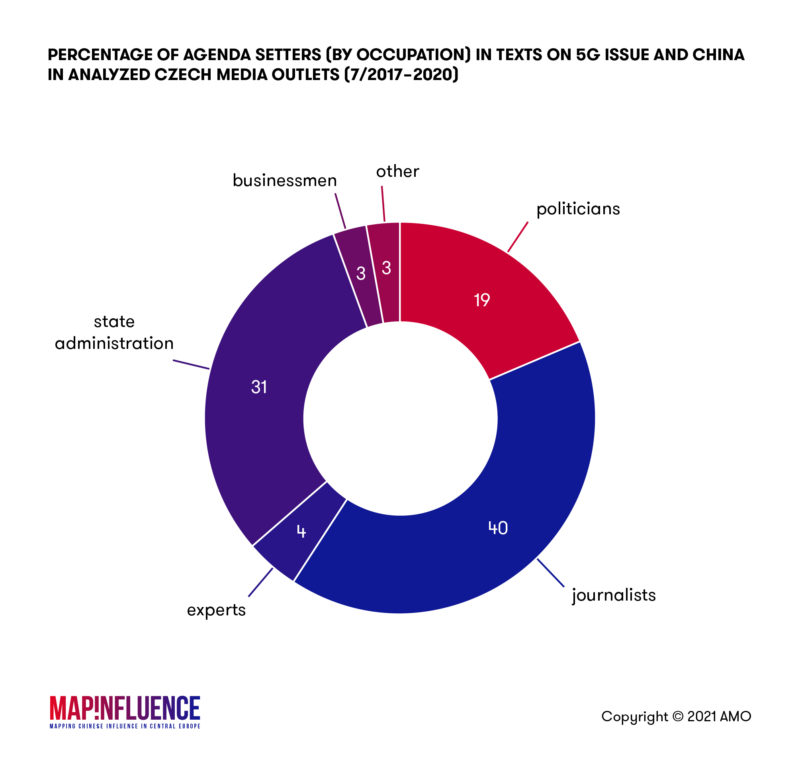

Regarding agenda setters, 318 people were identified as contributing to the discourse in the analyzed period either as authors, co-authors, or quoted persons.

The largest group constitutes journalists (40 percent). Nevertheless, the key agenda setters have not been persons but institutions and state administration staff (31 percent) and politicians (19 percent).

Interested in comparing the results with the situation in the other V4 countries? Check out the country analyses below.